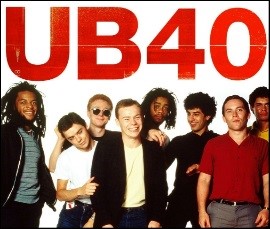

What I’m talking about is the situation you find yourself in right now. There’s so many things that can impact on your life, losing your job, losing your partner, being on benefits etc. Talking about benefits, I’m a UB40 fan as I’ve been there, got the T-shirt, nothing to be proud of but hey, nothing to be ashamed of. They were reggae on the “Rockn’roll” (The dole). 😊

Essentials and Non essentials

Once you complete the Money Master you will learn to differentiate between Essentials and Non essentials (NE’s). This is basic stuff yet it’s ignored by the majority of people for whatever reason. One good habit is to make sure you always put aside money for the mortgage or rent, electricity, gas council tax and food before NE’s come into play.

Let’s tackle debt

If you are one of the majority of people that have debts; a good place to start on your money affairs would be to look at the options you have to reduce the interest rates. Naturally, start with the debt that has the highest interest rate and see how you can reduce the balance. We’ll cover the debt topic later on. If debt is affecting your health, mental or otherwise click here for FREE independent help.

Know your enemies

There’s a good argument that we are our own worst enemies and as true as that may be there are hidden enemies.

Banks and lenders are thieves lying in wait for you to drop your guard. In many cases the banks know you can’t really afford the loans they keep teasing you to take out. It’s quite common to let bailiffs do the bank’s dirty work which only incurs further debt. Don’t ever trust banks, they are the enemy! The austerity we have been living through was mainly due to banks being reckless with our money; yet the Govt. bailed them out.

If only we could start at the beginning

In the beginning you had to pay upfront, no cash, no goods. Simple, but it worked a treat, no debt. Okay I know it’s the 21st century, I’m just saying that with “old school” ways; you to wait until you had the cash to pay for what you want. If you think about it, it’s this impatience or lack of discipline that creates a lot of the debt, if we could just wait. Next up we have “How to solve money problems” so make sure you read your blog every day.