Why you should Never, Ever trust your bank

If you think about it, there’s many reasons you should never trust your bank. The main reason is their abysmal record of being untrustworthy over many years. The banks have been cynical in the treatment of their customers, you included so you have every reason to be cynical with banks.

There’s nothing wrong being cynical; it acts as a safety mechanism and can protect you against enemies. Look, it’s difficult not to trust someone with a pin-stripe suit or corporate top in a bank, but there lies the rub. Let’s have no doubt here, you really should regard banks as the enemy. Let’s look at some cold “facts” why consumers have lost trust in banks. Simply put, Banks rip you off.

Here are just three examples why you should Never, Ever trust your bank. Reading scandal – Some employees at one bank, notably the Bank of Scotland’s (HBOS) were at their most evil in a scam they used against innocent and decent business people, between 2003 and 2007.

The HBOS employees literally ruined the lives of many by unnecessarily breaking up their struggling businesses. Instead of supporting the businesses the HBOS employees defrauded the businesses out of millions of pounds, leaving hundreds of people in dire financial trouble. This bank scam broke up previously happy families and marriages.

The scam worked by referring small businesses to a consultancy, which loaded the businesses with obscene debts and fees. It was these same debts and fees that led to the failure of the businesses and resulted in the ruination of their private lives. The bank knowingly put them through hell; while the fraudsters allegedly spent the proceeds on things like luxury holidays.

HBOS were fined £45.5 million for failing to disclose information about the scandal. That fine was pathetic and a disgrace in itself!

The PPI (Payment Protection Insurance) scandal ran for 20 years between 1990 and 2010 when an estimated 64 million policies were sold. The scandal led to the largest consumer compensation scheme in British history, with an estimated £50 billion paid to claimants. PPI was meant to cover loan interest and repayments if the customer became unable to pay. The whole scheme was a scam when financial institutions knowingly stole from consumers who trusted them. The banks broke the trust of millions of consumers, think twice before trusting them again.

Note: Martin Lewis, founder of the Money Saving Expert website, said on PPI, “Banks had lied to customers that certain types of insurance were compulsory, yet no banker had been prosecuted over the issue. He tweeted: ‘Bank’s [SIC] PPI selling was a systemic, deliberate, scripted, protection racket to mis-sell £billions of insurance.” End. One word I would add is theft, as the banks stole from consumers, the customers that trusted them.

The LIBOR scandal and the *Rain man. LIBOR was an attempt by banks to manipulate what many consider to be the most important number in the world. In simple terms the Libor scandal was a scheme in which bankers were falsely inflating or deflating their rates to profit from trades. The financial institutions that were implicated in the scandal, included Deutsche Bank, Barclays , Citigroup, JPMorgan Chase and the Royal Bank of Scotland.

*Rain man – Libor’s demise was in no small part down to the “brilliance” of a single trader; Tom Hayes nicknamed “Rain Man” who has a mild form of autism. Hayes was found guilty of conspiracy to defraud and was later convicted for rate-rigging in the scandal. There’s evidence Libor ran for nine years from 2003 until 2012. SONIA the Sterling Overnight Index Average replaced LIBOR in April 2017 for GBP trading.

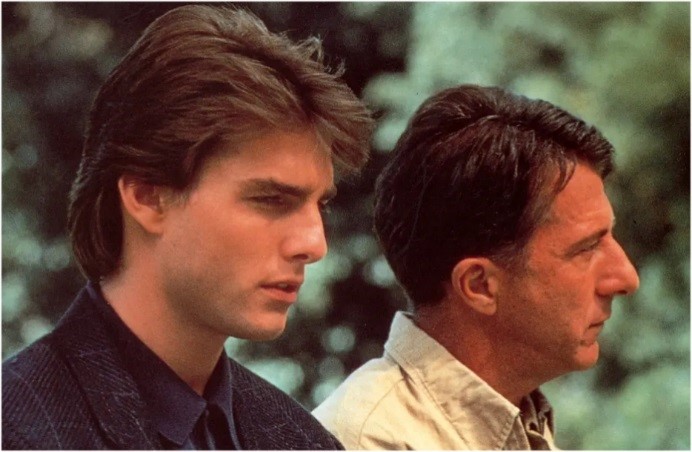

*Rain Man the movie starred Tom Cruise and Dustin Hoffman. Hoffman was the Rain Man who happened to be brilliant with numbers and also had a photographic memory. Hoffman and the Rain Man character was at the time recognised to have made the A word; autism, publicly visible.

The Reading scandal, PPI and Libor are just three reasons of many why you should never, ever, trust your bank. I do hope you get it.

Fore-warned is fore armed, don’t think for one minute these stories don’t affect you as they affected tens of millions of “customers”. The victims of these three scandals never thought their banks would rip them off. Just imagine how the victims felt when they lost their homes or were forced to move homes due to the mortgage endowment shortfall scandal. All scandals were about money, money and more money. Pure greed by banks.

STOP rip-off banks – Banks have a proven record of ripping off consumers; it’s time to start building bridges of trust between banks and their customers. A new banking infra-structure would be a good start. There’s too much Conflict of Interest in the banking system for it to be impartial. The system is broken.

“Which” has been saying this for many years but the banks protect their own. Examples are that banks are the paymasters of both the Financial Ombudsman Service (FOS) and the Financial Conduct Authority (FCA). They’re never going to be fair and impartial, no chance. How can FOS help consumers if it means going against their paymaster?

How to beat the banks and save tens of thousands of pounds, euros, dollars whatever

Follow my blogs to learn how.